If he had started investing just a few years earlier, his wealth could have exceeded $130 billion by now. But don't worry, he'll soon reach it anyway. An 8% annual return on a $118 billion fortune means a profit of nearly $9.5 billion, more than he earned in the first sixty years of his life.

The sooner you start, the more you earn

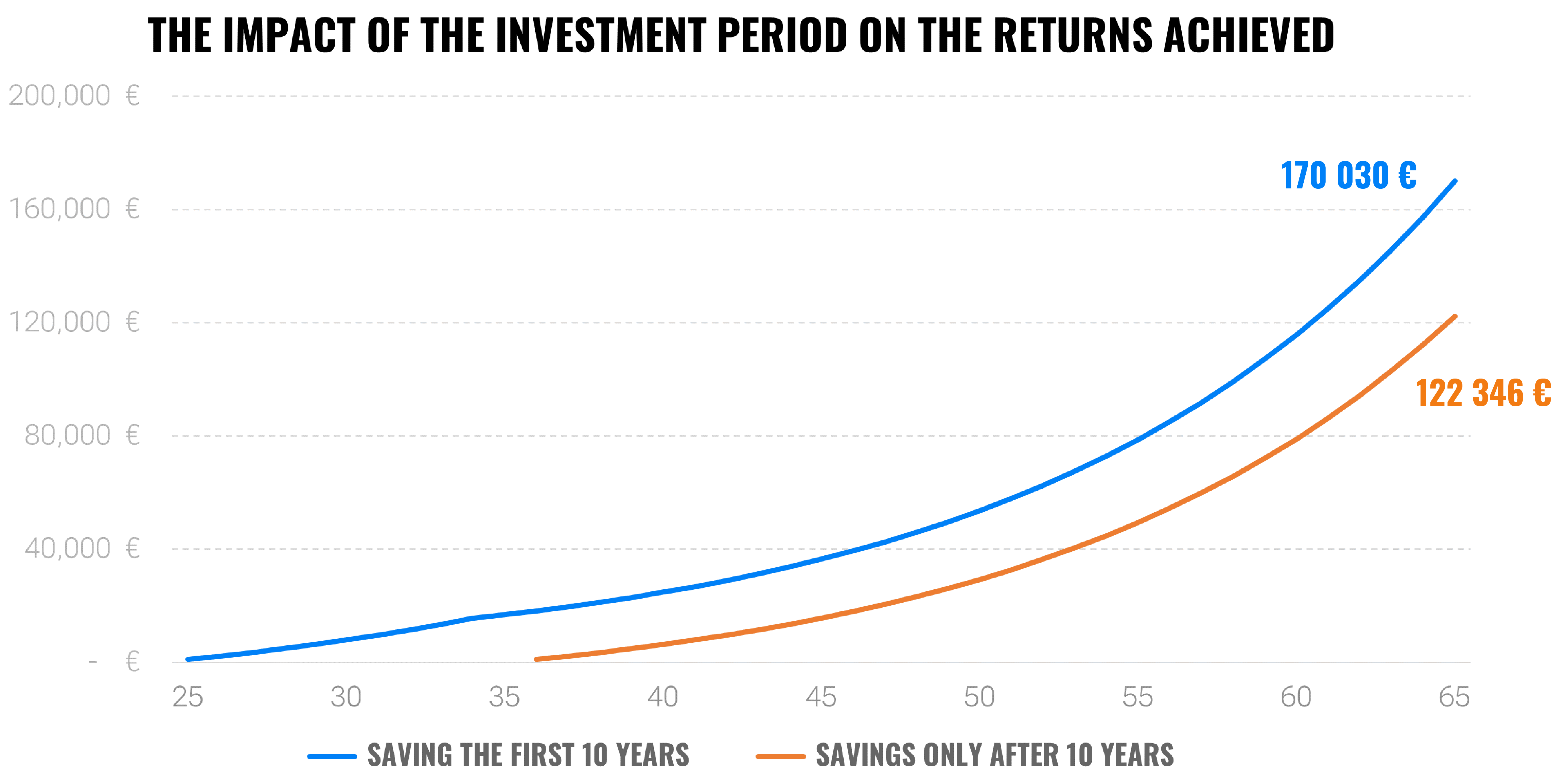

Only long-term investment is a guaranteed recipe for success in financial markets. Therefore, do not unnecessarily delay the decision to start investing. Every year is important. To showcase this principle, we can look at the different paths and outcomes of two investors:

Ms. Smart started to save for her pension regularly and invests 1000 euros per year (less than 3 euros a day) from the age of 25. This represents two coffees a day that she had to temporarily leave out in return for better future.

After ten years, she decided that she had already done enough and that the rest will be taken care of by time and compound interest. Thus, she will no longer put money to her retirement savings account. On retirement, however, she will still have saved approximately 170 030 euros, which combined with the state pension ensures a comfortable retirement.

On the contrary, Mr. Lazy spent during the first 10 years of his working life all the money he earned and saving or investing was not even a part of his personal budget. But after long discussions with Ms. Smart, he also understood the benefits of long-term savings and investment. At the age of 35, he also began investing € 1,000 per year.

Even if he invested 1000 euros per year for the next 30 years, he won’t be able to catch up to Ms. Smart. Despite investing 30,000 euros (which is three times more than the money invested by Ms. Reason), only € 122,346 (nearly € 50,000 less), will be waiting for him for retirement.

To catch up on the missed 10 years of investment, he would have to invest up to EUR 1400 a year, or approximately EUR 117 a month, over the next 30 years. To achieve the same result as Ms. Smart does with investment of EUR 10 000, he would have to save and invest up to EUR 42 000.

Who will be the first trillionaire?

The race to reach a market value of $1 trillion on the US stock market was won by Apple in 2018. Today, its current market value is not $1 trillion, instead, it has hit the $3 trillion mark, and its price has been steadily rising in recent months. In its wake, Microsoft has lagged behind, with a value of $2.4 trillion in mid-2023.

But it may not be long before the first person whose personal fortune exceeds a thousand billion dollars is written about. The closest to that mark today are Elon Musk (Tesla, SpaceX) and Bernard Arnault (LVMH). Both own companies that are among the market leaders, so it is conceivable that they could become trillionaires in just a few years' time.

Nor would they need to rely on the further explosive growth of their companies' shares. They can take their leave and wait with their feet on the table for time and compound interest to do all the work for them.

Create an account and start investing today

If they invested their wealth in the stock market over the next 20 years, they would reach $1 trillion before retirement age. By comparison, Warren Buffett is now 92 years old and has a fortune of about $118 billion.

None of the readers of this blog are likely to become trillionaires, but achieving more modest financial goals will certainly please you. Whether you're investing to be better off in retirement, saving to buy your dream home, educating your children, or building wealth, compound interest can do wonders for you, too.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty