What will you learn from this text?

- what is a benchmark,

- how to compare active and passive investing,

- how much does active investing cost,

- what is a market and whether a market portfolio exists,

- how much does diversification cost.

S&P Global recently published its semiannual report on the performance of actively managed funds. SPIVA, as the report is called, again proves that over the long term only a handful of funds beat their benchmarks (a benchmark is a model portfolio, made up of, for example, one or more indices, which provides a reference point for making judgments about a fund's asset management performance). Concrete results?

It Is Impossible to Win Against the Market

Source: S&P Global

Let me explain: if one invests in EUR currency global equity funds, the funds' performance is compared to the S&P Global 1200 index. In the last year, 65.3% of active funds lost to this benchmark. Over a 3-year horizon, already 83.1%, over a 5-year horizon 87.5%, and over a decade horizon 97.7%. In other words, roughly one active fund in fifty has managed to beat passive (index-based) investing over the last ten years.

The longer the investment period, the lower the chances of beating the market. Even the legendary Warren Buffett had three consecutive years in which he lost to the S&P 500 index (2003, 2004, 2005). At the same time, his investment vehicle has averaged a 20% return annually since 1965 against a 10% benchmark, which may support the thesis that it is possible to win against the market. Before you get used to it, however, answer the question of how many Warren Buffetts you know and whether you believe you could be the next one.

Create an account and start investing today

Beating the market is simply a big art. I know people who can do it, but there are literally only a few of them. They dedicate all their time to it, treat it as a profession, and on top of that, they have unique personality traits and, needless to say, a lot of luck.

Most investors lose with the market, and the reasons are probably already known to you because they lie at the heart of the Finax philosophy. Management costs, emotions, inconsistency, brokerage commissions, changing strategies, market timing (when you believe it's a bottom or a top), and investment fads. Is it enough?

If not, add to that your time. The one you spent on analyzing charts and numbers. Reading press releases, interviews with CEOs, and reports from brokerage houses. This also has its price.

Check if you are winning with the market. How?

If You Can't Beat It, Maybe It's Better to Join In

You must assume with a high degree of probability that you are not beating the market. If you assume otherwise, you are either Buffett or a victim of one of the behavioral errors we often write about, namely overconfidence. So let's look for a benchmark so you can find out for yourself and your own portfolio.

The smart investor will therefore bet on the market. What market? Diversified. Globally, geographically, by currency, by industry, by segment. Including stocks and bonds. Why not local (e.g. only European, American, and emerging markets)? Why not be limited to technology or commodity companies? Because then again you might fall prey to what I wrote about above - the belief that you can predict which country/sector will beat the market...

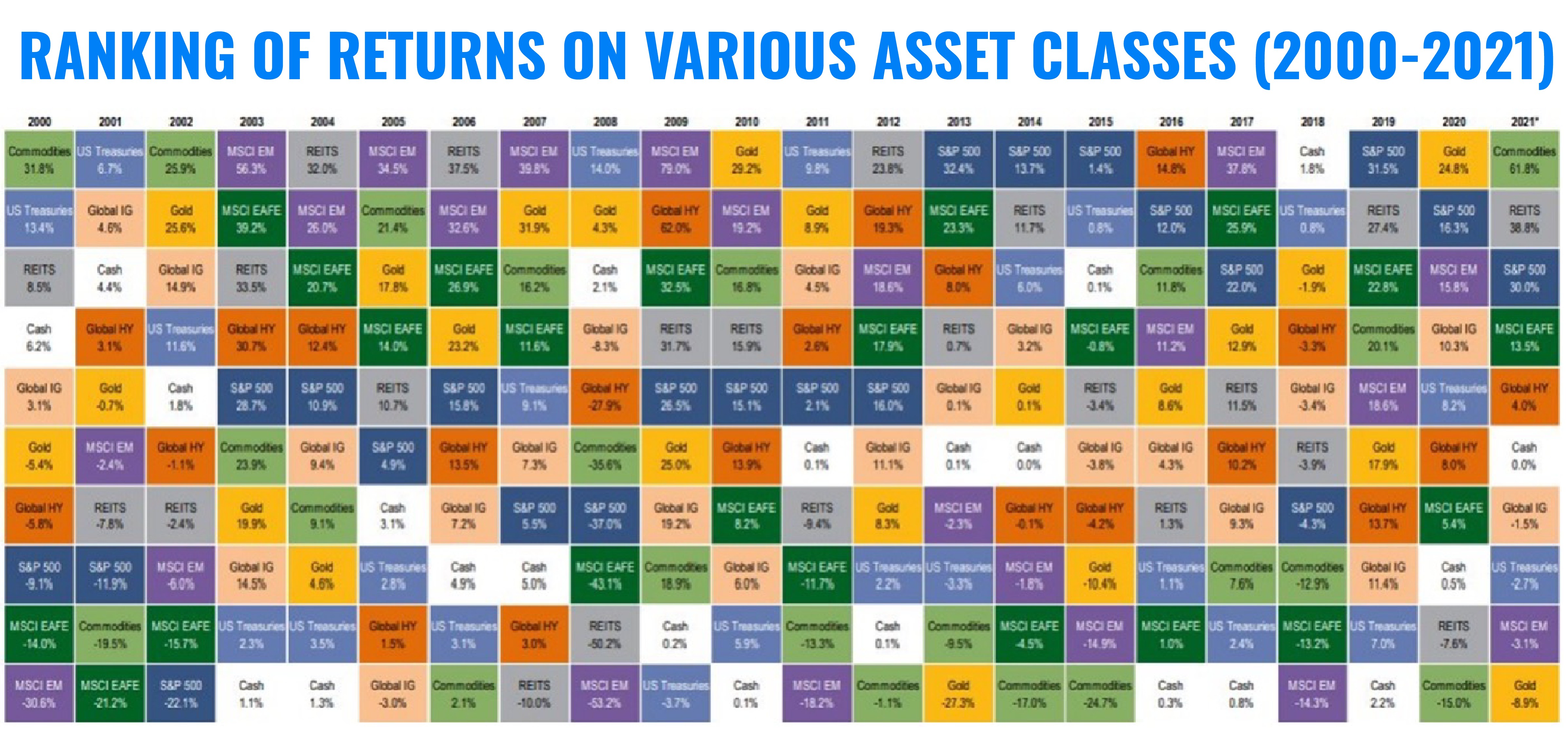

Source: Bank of America

Is it shimmering in your eyes? You can see for yourself that the ranking of the best market segments adds up to an increasingly complex jigsaw puzzle every year. And that's where companies that offer a diversified, global portfolio of stocks and bonds come to the rescue. Like Finax. What do we have in our portfolios?

- 7391 - that's how many company stocks are in the 6 equity ETFs that make up the Finax portfolios

- 5965 - that's how many bonds are in the 4 bond ETFs that make up the Finax portfolios

- 92 - that's how many countries the issuers of securities in these 10 ETFs come from

Which security makes the biggest contribution to the value of Finax's equity portfolios? Apple and Microsoft stocks. That biggest impact is just 2.3% each in both cases. Diversification! Do you have sentiment towards any specific country? We don't. Neither do global funds.

The market for 10 EUR

How much do you need to invest? In Finax you need just 10 EUR and you can already check if the time you spend analyzing charts and numbers pays off.

Try invest tax smart with low cost ETF funds.Let your money make money zarábať

We can do it with such a small amount because the robo-advisor buys and manages fractions of ETFs for you. Individual ETFs often cost much more. Want to buy one each of ten ETFs from Finax's portfolios? That's €1109 (mid-September 2021 calculations).

How much would you have to pay for full ETF units if you wanted to buy them yourself and build a Finax-like portfolio? That's a one-off expense of €1020 (a 100% equity portfolio), €2040 (a 50% equity portfolio), or even €3280 (the popular 80% equity portfolio). In each of these cases, you would still, by rounding up, have several percent cash left in your portfolio.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty