Whether we are talking about regular monthly investing or a one-time larger investment, it is always most important to consider what I want to gain from the investment in advance.

Do I want to protect money from inflation or will I need money to repair a roof or buy a car in two years? Or do I want to build sufficient wealth for retirement? Alternatively, I might want to save up for my children to get them started in their lives.

You can set up your investment correctly only if you specify how you want to utilize the funds in the future. At the same time, this will reduce the risk of panicking and considering a funds withdrawal from your investment account during the next market decline.

I consider opening only one investment account, to which all funds are deposited, to be one of the biggest investment mistakes our clients make. Consequently, people are worried about questions of whether their investments are well-set, whether they will not take greater risk and unnecessarily lose potentially higher returns.

But what if I will need the money sooner, before reaching the investment horizon? What then? People often chase returns, unaware of the risk associated with a high proportion of stocks in the portfolio.

Note: All data related to the historical development of Finax portfolios are modeled and were created based on backtesting of the data. We described the method of historical performance modeling in the article: How do we model the historical development of Finax portfolios. Past performance is no guarantee of future returns, and your investment may result in a loss as well. Inform yourself about the risks you are taking when investing.

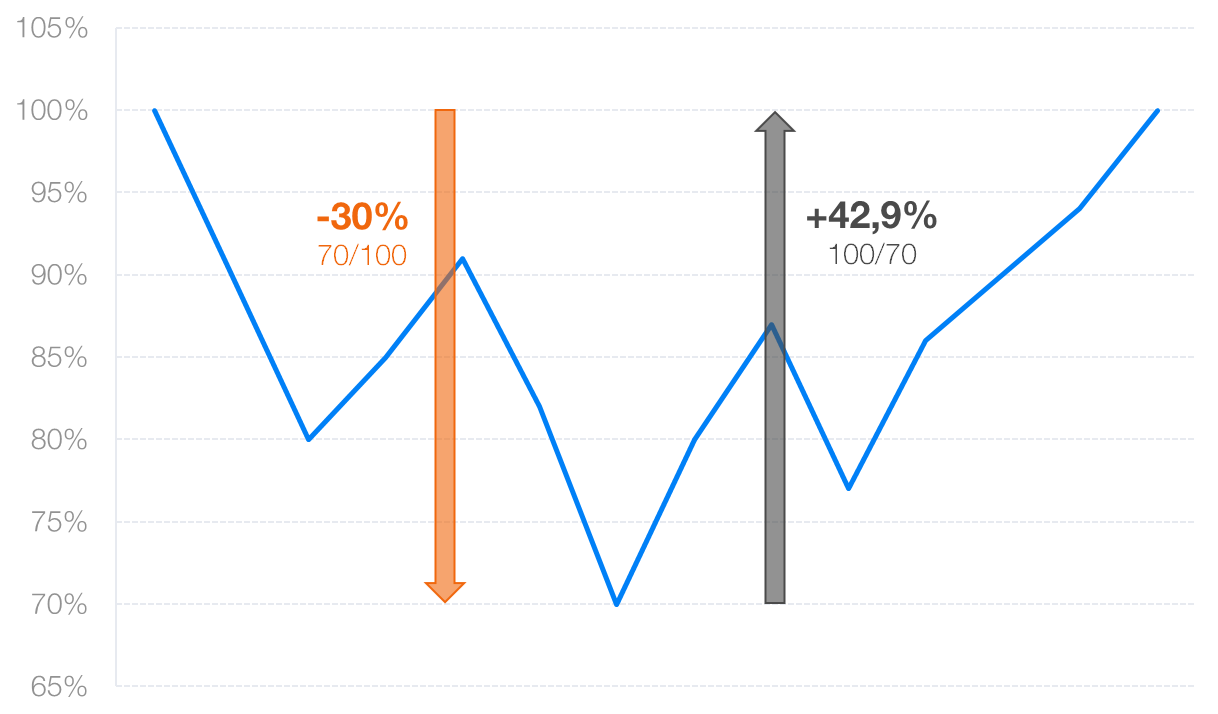

How will you deal with the adverse period when the value of all your invested assets will fall by, for example, 30%? For better visualization, imagine that you have invested 10 thousand euros and suddenly have "only" 7 thousand euros. Do you understand that in order to return to the initial value, you need your investment to increase by almost 43%?

Your account may return to its original value within a couple of weeks or months. But what if the return takes several years? Will you withdraw funds at a loss just because you need to buy a new boiler for your house or pay for your child’s studies abroad?

Divide and rule

Each of us has many plans in life. These plans vary in time, and also in their financial complexity. I will need less money for next year's vacation than for paying off my mortgage early in 18 years.

For this reason, it is not appropriate to keep all available funds in one account, using one strategy. Long-term, medium-term, and short-term money should be strictly separated.

For example, if you have two children, it is advisable to save for them in two separate accounts, which you can, in addition, name according to the names of your children with us. If one child is 6 years old and the other 12 years old and you want to save for them until they reach the age of 18, the investment horizon will differ by 6 years. This difference in the horizon already means that the same strategy should not be set in both accounts.

How do I do it?

Some of our clients maintain more than ten investment accounts with us. To some, this may seem unnecessary. "I will open three accounts - for the reserve, the medium-term goal, and retirement - that must be enough."

However, the truth is that the more accounts you have, the clearer overview of your investments you can keep. Even within the mentioned time horizons, we can have more plans.

So, let's see how my investments are set up. I keep a short-term reserve, intended to cover unexpected costs or a loss of income, separately from the funds in the current account. This way I avoid emotional purchases of things that I don't need.

Money intended as the so-called iron reserve does not serve for buying new clothes just because of an ongoing discount offer in stores. Whenever I am forced to reach for this reserve and transfer money from it to my current account, I think twice about this step.

I plan to sort out new housing in about a year, a maximum of two. I am afraid to invest the funds I have saved for this purpose too risky. Therefore, I decided to use a conservative portfolio, which is not threatened by any major collapses. On the other hand, I cannot expect extreme returns. It is ideal to achieve an evaluation that will cover at least inflation or a portion of it.

I will probably need a new car within five years. I do not need to keep this money conservatively, but on the other hand, I am afraid of a decline right in the fifth year. Hence, I chose a balanced 50/50 strategy (stocks/bonds).

In the horizon of roughly ten years, I would like to have built assets for the coverage of expenses associated with the house, whether it is a new boiler, repair of the facade, or replacement of windows. When owning real estate, it is advisable to prepare for such expenses as well.

Try invest tax smart with low cost ETF funds.Let your money make money zarábať

Ten years is already a pretty decent horizon. Even if the value of the investment falls in the fifth year, it still has plenty of time to recover. However, this cannot be a major decline, as in that case, the investment may not be able to recover by the time it is used. A growth strategy will be ideal in this case. I personally chose 80/20 (stocks/bonds).

I plan to pay off the mortgage early within 15 to 18 years of buying the property. In addition, of course, I want to start saving for the basic goal of retirement already today, and it would also come in handy to save something for the children’s school, possibly their start in life, a wedding, etc.

A horizon of 15 years or more is considered long enough to minimize the risk of loss. For this purpose, I chose a dynamic strategy of 100/0 (stocks/bonds). With funds composed purely of stocks, the risk associated with investing is the highest. On the other hand, returns are also the most attractive.

Anticipate the consequences

Situations, where it is necessary to use funds from your investment accounts, will also prove why dividing your wealth among several accounts makes sense. Whether it comes to expected or unexpected events, you always have the option to withdraw funds from the account where it is the most reasonable.

If your washing machine breaks down and you need a new one, you will reach for the short-term reserve. When you decide to buy a car in 5 years, you will withdraw funds from the account designated for that purpose.

One of the common mistakes is that people save for retirement and rely on withdrawing this money and using it for another purpose in case of emergencies. This is a huge mistake that you will not regret today when buying a new car, but only once you are retired and then it will be too late.

Money earmarked for long-term goals should be "untouchable" and protected from withdrawal before it really makes sense. In addition, our annuity portfolio can continue to evaluate your wealth, letting you earn income from it, paid monthly as a retirement benefit.

One of the advantages of investing with Finax is the ability to change all parameters in a few clicks without any fees. Once a year, you can change the strategy in each of your investment accounts.

For example, if you’re saving for a new car and find out that you don't really need it after a few years, you can simply set up a more dynamic strategy in your account. It's up to you when you withdraw money from your account.

If you are interested in how to change the parameters of your investment, we have prepared answers to the 11 most frequently asked questions of our clients. Here you can also find information with video instructions on how to change account settings, strategy, how to upload a new ID card, and so on.

Investing is not about finding and choosing one perfect goal or product. None of us has just one life plan to which everything adapts. Unexpected events in particular can significantly shuffle the cards in the family budget.

It is all the more important to prepare for planned expenses such as raising children or retirement. Therefore, take care so that your savings do not lose value and distribute them wisely over time so that you can fulfill your dreams in the future thanks to them.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty