If you transfer your investments to Finax to April 15th 2022, we will manage the value of the transferred investment at no fees for a year.

Why Should I Transfer Investments to Finax?

- Interesting long-term returns which outperform the appreciation of mutual funds.

- Simple and efficient investing in stocks and bonds of the entire world (passive investing).

- Profitable index ETFs.

- Finax is cheap - no hidden fees.

- The investment risk is widely spread.

- Investing is fully automated, convenient, and worry-free.

- Returns are tax-free after one year of holding (for Slovak tax residents).

- Finax is an innovative securities trader.

- You will get an extraordinary discount that makes investing with Finax even more favorable.

Note: All data related to the historical development of Finax portfolios are modeled and were created based on backtesting of the data. We described the method of historical performance modeling in the article: How do we model the historical development of Finax portfolios? Past performance is no guarantee of future returns, and your investment may also result in a loss. Inform yourself about the risks you are taking when investing.

The Way You Invest Matters

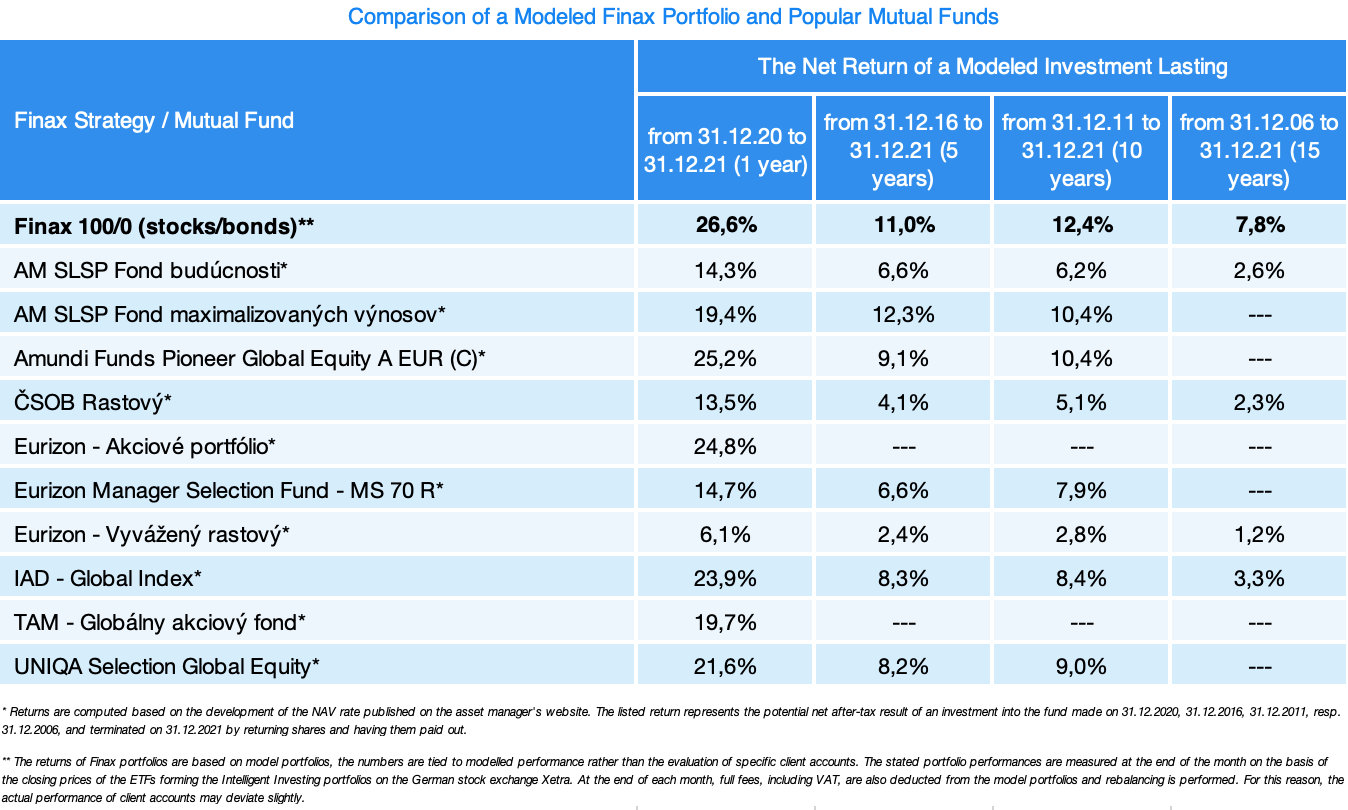

In the Finax model portfolio, you would have turned 10 thousand invested euros to 32,213 euros over 10 years. In equity mutual funds, your savings would reach a value of 22,941 euros over the same period.

The difference amounts to 9,272 euros. A fortune that makes it worthwhile to transfer an investment.

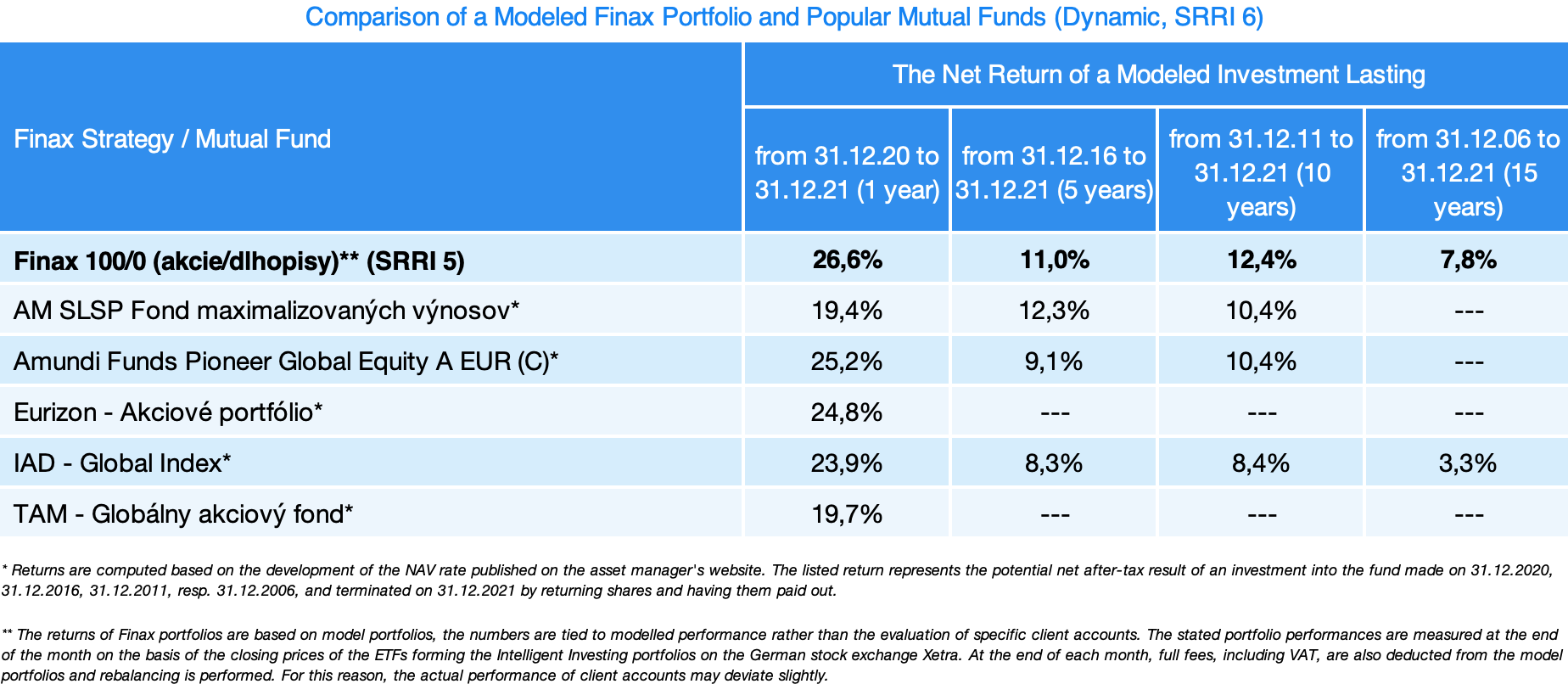

In the case of mutual funds, we average the actual after-tax net returns of the largest equity mutual funds with a 10-year history of six asset management companies offering services in Slovakia. The funds and their appreciation can be found in the table below.

Comparison of returns of Finax and popular mutual funds as of 31.12.2021.

How Do I Transfer My Investment to Finax?

- Terminate your current investments in competing, less profitable products.

- Deposit funds into your Finax account within 30 days of terminating your original investment.

- Document the termination of your investment with a bank statement or a confirmation of sale, cancellation, or return of shares in the fund.

- Enjoy investing at a zero fee – we will manage the value of your transferred investment for a full year without charging the portfolio management fee.

Please see below for more information and detailed discount conditions.

Can I Utilize the Discount even if I Am Not a Finax Client?

Yes, simply open a Finax account online, meet the activation requirements, and proceed to the investment transfer as described in this blog.

What Investments Are Acceptable to Qualify for the Discount?

You can get a discount for transferring investments from:

- mutual funds,

- direct investments in stocks, bonds, ETFs,

- managed portfolios of securities broker-dealers,

- investment and endowment life insurance,

- cryptocurrencies,

- precious metals,

- housing savings plans,

- investment certificates.

What Other Conditions Have to Be Met to Get the Transfer Discount?

- The funds deposited to Finax must come from another investment.

- The deposit must be credited to the Finax account no later than April 15th 2022 and no later than 30 days after the termination of the original investment.

- The deposit can also be made in multiple payments, for instance, if you are limited by your internet or mobile banking setup.

- If terminating the investment in some products takes longer, we will also accept deposits credited after this date on an individual basis.

- Termination of investment in competing products must be documented by sending the necessary documents by email to client@finax.eu, ideally after the payment has been credited to Finax.

- The document must identify the client, the date of termination, the value of the investment, and must clearly imply the termination of the investment.

- The document can be a confirmation of returning fund shares, a sale confirmation, a contract termination confirmation, a sales contract, a transaction statement, or a receipt of payment from internet banking with the sender clearly identified. By law, you must always receive such confirmation upon the termination of your investment.

- We will waive the portfolio management fee charged from the amount equal to the value of the transferred investment for 12 months in the account to which you deposit the funds.

- The discount will be applied to an amount up to the value of the terminated investment, resp. to the value of the deposit, in case it is lower than the amount of the terminated investment.

- The discount applies only to the portfolio management fee. The investment transfer does not affect the payment processing fee or investment advisory fee if these were to be charged.

- The minimum amount of the transferred investment to qualify for the discount is €1,000.

- You will be notified by email once the discount has been credited to your account.

- The discount can be further combined with other discounts. Their overview can be found in this blog.

Example:

You are not a Finax client, but you invest in mutual funds. The current value of your investments is 10,254 euros. You open a Finax account and terminate your investment in the mutual funds by returning the fund shares on 10.3.2022. The funds are transferred to your bank account on 15.3.2022.

You deposit 15,000 euros into your Finax account. The funds are credited on 17.3.2022. You document the investment termination with a confirmation of the return and redemption of the fund shares and a detail of the payment of 10,254 euros received to your bank account, which you send by email to client@finax.eu.

Finax will apply a discount of €10,254 in your account, valid from 17.3.2022 to 16.3.2023, i.e., you will pay zero portfolio management fee from this amount during this period. You will only pay it from the amount exceeding the value of the discount. In this case, the portfolio management fee would be charged on the amount of €4746 (15000-10254), should the value of your account remain at €15,000 for the whole year.

Don't hesitate and exploit the opportunity to invest free of charge for a year. Start investing profitably and efficiently. Invest with Finax, build wealth faster! Your money is at stake...

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty