If you want to learn more about the projected development of your portfolio value, we prepared a new advisory section for you. However, for the advice to be correct and precise, you firstly need to make sure that all the parameters of your investment are correct and up to date.

You need to begin in the Settings section

After logging into your account, click on your name in the top-right section of the page and then click on Settings. In this section you can update:

- Personal information (for example, changes in address, phone number or tax domicile)

- Security (email, second layer of authorization through SMS)

- Investment profile

Investment profile is the most likely to change over time. Finax tailors your investment strategy to your current financial situation, your relation to risk, investment horizon or your experience.

Clients that forgot to name their investment account during their registration can change its name in the section Investment profile. The only thing that cannot be adjusted is the goal of your investment.

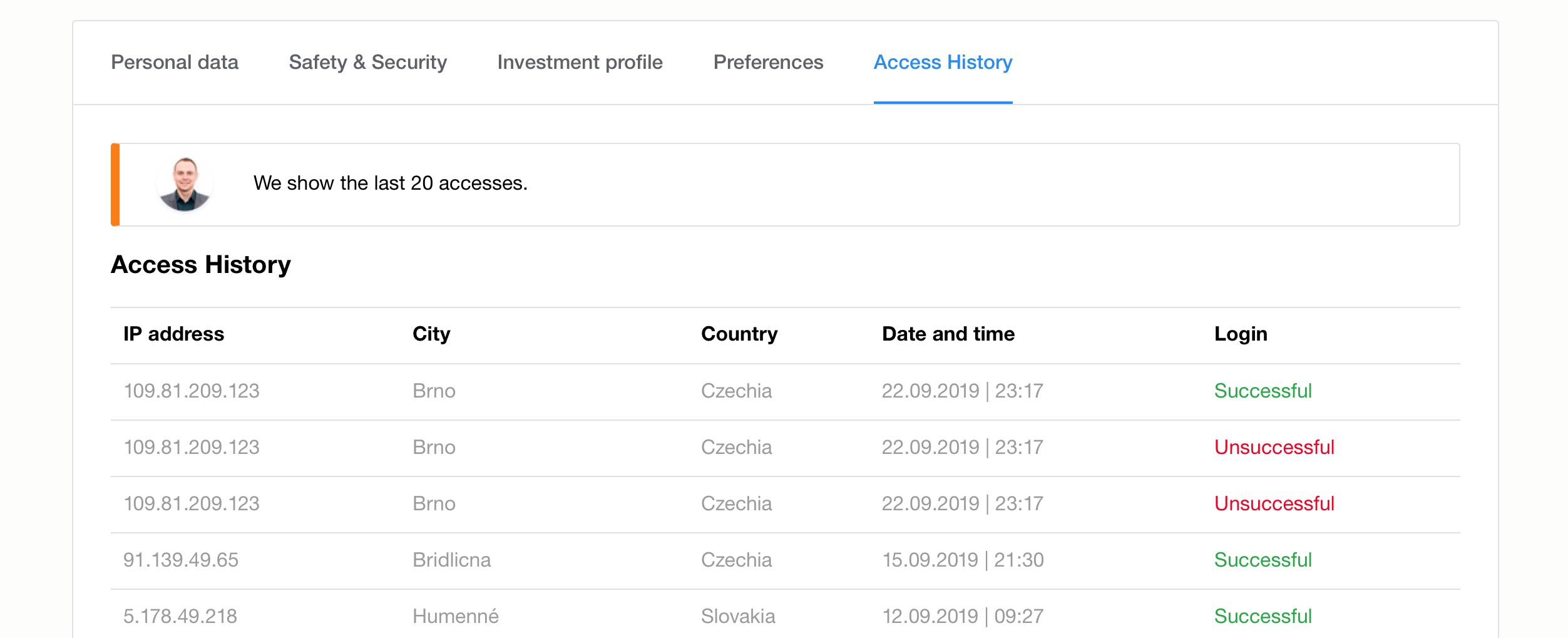

At last, we added another security feature. It shows you a history of successful and unsuccessful login attempts along with the IP addresses that were used for the login attempts. You can use it in order to find out whether an unauthorized person logged into your account.

Now let’s look at the Advisory section

Do you want to make a one-time deposit or increase your regular monthly deposits? Do you want to see the effects on your portfolio’s future value? Try it out in the new Advisory section.

Apart from this, you can also adjust the target amount of your investment and its risk. Let me elaborate on this. If you updated your investment profile in the past, you will only be able to adjust your strategy to a level that corresponds to your updated profile. The recommended risk level can be higher or lower based on you answers.

Any change in the settings requires an SMS authorization. If you also change your risk profile, you will need to approve a new investment strategy.

The information will be submitted to us as a request. After our check, you will receive a notification about the changes via email.

Do not forget

When there is a change in the investment strategy, the composition of your portfolio will be adjusted on the first investment day. For example, when you increase the share of stocks, we will probably sell your bond ETFs and buy stock ETFs. This may result in tax liability and a need for a tax report.

A change in the investment strategy of an investment account is once a year free of charge. If you wanted to change your investment strategy more than once a year, we charge 200 euro for this operation to cover the transaction costs.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty