Recently, we have observed an increased number of attempts by scammers to defraud our clients by imp...

Why Do We Rebalance Our Portfolios?

Finax was among the first players who introduced automated regular rebalancing to the Central-European markets. What does this term mean, and how can it benefit your investment?

- What is rebalancing?

- Rebalancing keeps the portfolio's risk at an appropriate level.

- Rebalancing steadily increases the return on investment.

- When and how do we rebalance?

- How can the process of maintaining a portfolio's structure enhance performance?

What Is Rebalancing?

Rebalancing, despite sounding as something tangled, is a simple concept that can be highly beneficial for your investment.

As the name suggests, it is about maintaining a portfolio's balance. Our mission is based on intelligent investing; therefore, we monitor the balance of clients’ portfolios.

Simply put, rebalancing means preserving the portfolio’s originally chosen composition, optimal for investors’ goals and their risk preference.

Start investing today!

Let's StartWhen opening an account with us, our algorithm selects a portfolio tailored to the client’s needs. Our investments are made up of 10 ETFs targeting different asset classes, for instance, shares of large US companies, small European companies, and global government bonds. Accounts of individual clients differ in their compositions based on the selected risk.

However, the portfolio's composition changes over time. Different asset classes never develop equally, some may grow faster than the others, or may even grow when the rest declines.

Stock prices, for example, change more frequently than bond prices - they are more volatile, but have historically achieved higher returns. Developing countries' or smaller companies' shares experience bigger price movements than those of big companies in well-established markets.

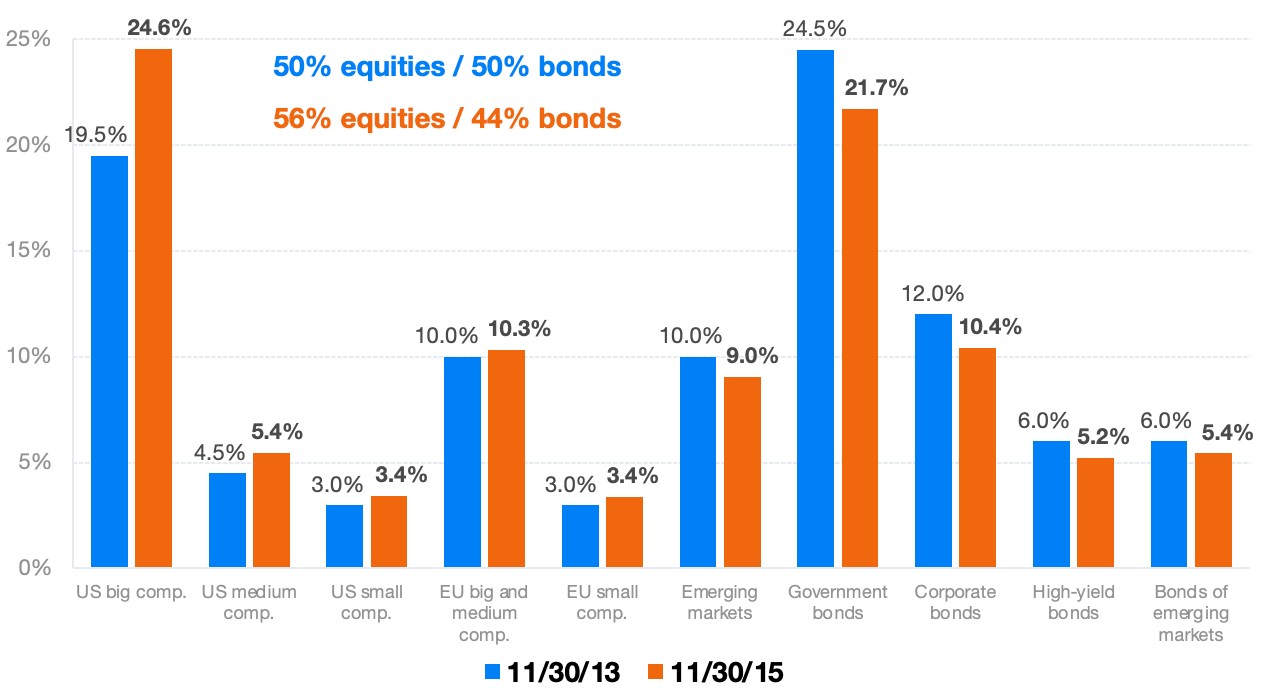

Their differences in development cause them to change the instruments’ weight within the portfolio. As shown in the following graph, comparing the composition of the 50/50 strategy (50% shares and 50% bonds) after 2 years, the proportion of the shares grows at the expense of bonds from the original 50/50 to 56/44 in November 2015.

Rebalancing means resetting the composition of the investment back to the optimal level - the original composition that was selected for the client at the beginning of the investment according to their objectives, options, and the ability to bear risk.

Rebalancing is carried out through a simple sale of a portion of ETFs whose current portfolio weight is greater than the weight set at the beginning of the investment. The received funds are then used to buy currently underrepresented ETFs whose weight in the portfolio is lower than it is supposed to be according to the original setting.

Why Do We Perform Rebalancing?

The quality of each investment is measured by the ratio of its return to the associated risk. Fundamentally, higher returns always brings higher risk and vice versa.

The portfolio manager's goal is to achieve the highest possible return while maintaining the lowest acceptable risk for the investor. Therefore, increasing returns while lowering the risk is a dream of every investment manager, and thus a holy grail of investing.

The main role of rebalancing in the management of our portfolios is to maintain the investment's risk at the chosen acceptable level.

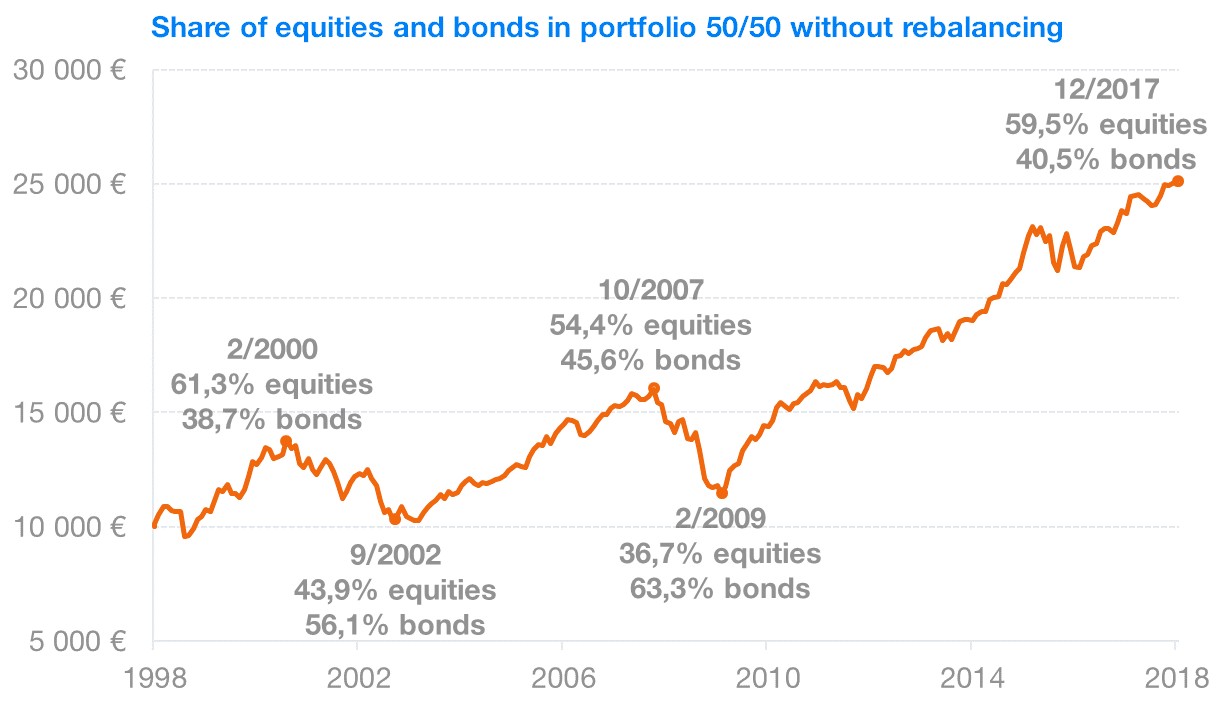

Mixed portfolios comprised of different asset classes tend to increase their risk over time. Stocks and other risky assets tend to grow faster than the safer assets over long periods. Consequently, their proportion in the portfolio increases and the investment becomes riskier.

If, for example, the algorithm selects a balanced portfolio of 50% stocks and 50% bonds as a suitable investment for the client, the equity weight will be 70% in a few years and the bond weight will be 30%. Such a portfolio is significantly different, involving a higher risk.

Note: All data relating to the historical development of our portfolios below are modeled and based on backtesting. We explained the process of modelling the historical performance in this blog. Past performance is no guarantee of future returns, and your investment may result in a loss.

However, the tables turn when the markets are declining. During those periods, portfolios become more conservative as the proportion of safer assets increases. Therefore, their potential profitability also declines, depriving the investor of potential future returns. You can see that it is more than wise to maintain a properly set portfolio composition.

Our goal is to maintain a stable portfolio risk at a level at which the investor feels comfortable. In addition, the law also requires the providers of managed portfolios (like Finax) to act in this way.

The Rebalancing Process and Other Benefits

We at Finax were not satisfied with the standard way of portfolio rebalancing. We wanted to know the optimal time and conditions under which to return the investment composition to the original level in order to maximize the client's benefit.

Through a detailed analysis and long-term testing of dozens and dozens of portfolio rebalancing methods, we have developed our own rebalancing system.

The result of our know-how is a rebalancing system that increases portfolios´ profitability and reduces their risk.

Over a 30-year horizon, rebalancing increased the performance of dynamic, growth, and balanced portfolios by an average of 0.41% per year. This effect is smaller for strategies with a larger share of bonds.

The benefits of rebalancing become more significant during the times of turbulence and of higher market volatility. Therefore, rebalancing has increased the returns of strategies with a larger weight of stocks by an average of 0.65% per year over the past 20 years.

Based on our research, we have created an interval of the weight of each instrument in the portfolio. Once the proportion of an instrument crosses the interval’s boundaries, it automatically rebalances the portfolio’s composition and returns it to the original state.

Our rebalancing is automated. The system monitors the composition of all clients' portfolios and if the portfolio structure changes significantly, it rebalances it.

We cannot foretell the exact day on which rebalancing will be carried out, as it happens when the need arises and not on a set fixed date.

Rebalancing never triggers a tax liability. Tax optimization is one of our core principles, and it has a priority over rebalancing. Thus, rebalancing can be postponed for several months if it would result in a capital gains tax.

Finax carries out rebalancing without charging transaction (or any other) fees.

Achieve higher returns

Start investing tax-smart via low-cost ETFs.

How Does Rebalancing Increase Returns?

Our clients often wonder how a simple re-setting of the portfolio's composition could increase the annual return by 0.65%. After all, it's a considerable amount, especially when compounded over many years. Even we were pleasantly surprised by the testing, so we studied the causes more thoroughly.

Firstly, rebalancing automatically employs another holy grail of investing - it sells when the prices are high and buys when they are low. It is an investment art that looks simple on paper, but only a few manage to do it consistently in practice.

Rebalancing does what every investor should, but often fails at doing due to psychological temptations. Simply put, the investor realizes investment profits.

The weight of the sold ETF funds is relatively higher than the initial composition, which means that their value grew faster than the value of the underrepresented funds. The relative performance of the purchased assets is worse; therefore, they are cheaper compared to the assets sold at rebalancing.

Declines of non-rebalanced investments are more significant and their advances are milder than those of rebalanced portfolios.

If equity markets drop by 20% and you have 60% of stocks in your portfolio instead of the correct 50%, the portfolio would decline by 12%, while it would have only declined by 10% if the portfolio's structure was set correctly. With 100% stock market growth, if stocks make up only 30% of your portfolio, the investment will advance by 30%, while in the optimal case of a 50% stock weight, the investment rises by 50%.

Rebalancing is a great instrument of passive investing, which is in turn the best way to build wealth. It automates the measures that should be a part of each investment strategy, although investors tend to neglect them for various reasons - maintaining the optimal level of risk, selling expensive assets and buying cheap ones, increasing the achieved return, and mitigating the declines.

Rebalancing represents another unmatched added value brought to you by Finax portfolios.

Warning: Investing involves risk. Past returns are not a guarantee of future performance. Tax exemptions apply exclusively to residents of the respective country and may vary depending on specific tax laws. Check out our ongoing and ended promotions.