You don`t have to be rich to invest properly

Finax offers fair and attractive investment conditions, which are the same for everyone. We bring to Slovakia the possibilities that small investors could until now only dream of.

Radoslav Kasík | Investment academy | 15. April 2018

Small investors do not have the same opportunities to capitalize on their assets as the wealthy do.

Finax brings in this field a revolution to Slovakia and EU and provides one of the most effective investment instruments on the market, which are available for everyone.

Why is Finax Intelligent Investing so much more favorable than its competitors.

We all know that ordinary people do not have access to the same money management options as wealthy individuals. When you come to a bank or a broker with a million euros, you will receive different care compared to when you appear there with 5 thousand euros.

Why are small investors often discriminated?

Indeed, you can hardly efficiently invest 5 000 euros. Some natural limitations aim to leave more sophisticated financial instruments in the hands of professionals or experienced investors. Likewise, it is not appropriate to invest small volumes in specific projects.

The second reason is partially an objective one. Usually, private banking has just as much work with a client that will make a million euros deposit as with a client investing 10 000 euros. However, the institution's revenues are disproportionate.

This is the reason why wealthier individuals are offered different services, fees, and products. Small investors have limited access to such products through high minimum entry investments. After all, it works in every business and service industry.

How do wealthy people manage their wealth?

Rich people are proof that investing leads to a better life. If one brings discipline and efficiency to his finances, there is a high probability that their wealth will grow. This will increase the investor´s financial security and create a source of passive income. Life with wealth is easier for everyone.

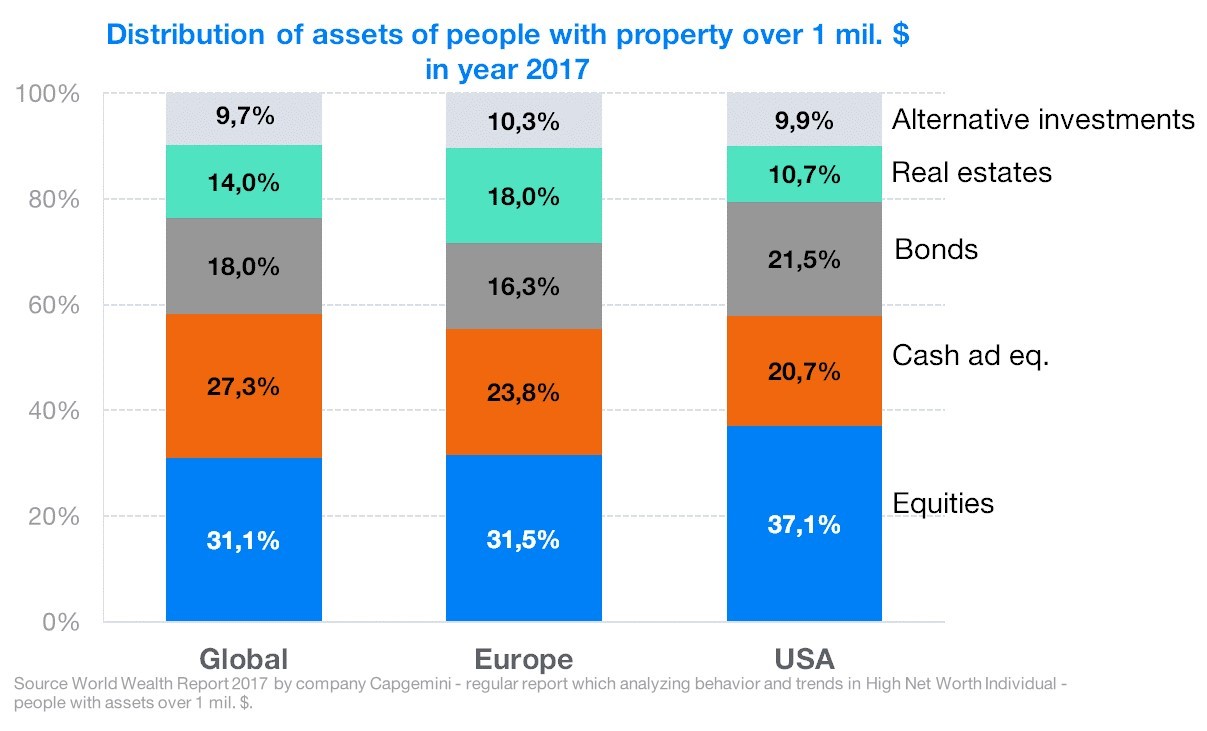

The following two charts show the structure of assets and the contribution of each asset class to the asset growth of wealthy people in 2017 - according to the World Wealth Report from Capgemini. The portfolios are dominated by shares, they account for nearly a third of the portfolio.

Wealthy individuals attribute equities the greatest credit for the growth of their assets - 9 out of 10 "rich people" see them as an important asset-enhancing factor and more than half as the most important one. Interestingly, they consider income from business and employment to have the smallest contribution to the growth of their wealth.

Finax offers equal conditions to everyone

In Finax, we believe that investing should be available to everyone on fair terms, the same as with public services. After all, each of us deals with money daily.

One of the revolutionary ideas that Finax brings is to make access to effective investment instruments available for masses. Every investor receives the same quality services, regardless of the size of his/her net worth, the size of the investment, social status or other characteristics.

You can hardly find a more favorable alternative for your savings

With Finax you can start investing from 10 € a month into more than 10 thousand securities worldwide. And all this with just one fair fee of 1% per year + VAT. For regular investments (savings), we charge an additional 1% to process the received payment.

Start investing today

Intelligent Investing offers a very simple and efficient way to capitalize on your financial resources. Copying world indices is the cornerstone of investing.

Besides, intelligent portfolios bring some of the highest returns on the market and offer tax-smart investing in the long term.

From the very beginning, we wanted to create a universal product for all. We do not see why good things should only be accessible to the rich.

To achieve this goal, we had to come up with a simple tool. Another prerequisite was a technologically advanced solution. Only technologies can ensure reliability, objectivity and cost reduction, from which you can then profit.

What investment possibilities did Slovaks have so far?

Usually, they were limited to mutual funds, private bond issues, managed securities dealers' portfolios or individually managed brokerage accounts, where they had to choose the instruments by themselves.

These forms of investments have numerous drawbacks compared to passive investing in ETFs, such as the one offered by Finax.

Mutual funds

have disproportionately high fees and poor results. Over the past 10 years, Finax's equity portfolio yield has exceeded the average yields of the most popular equity funds in Slovakia by 4% per year after tax deductions.

The fees for the administration and management of these funds range from 1.5% to 3% per annum. Also, they charge an entry fee of 4-5% of the investment volume. Their costs are at least twice as high as in Finax.

Private Slovak bonds

can be part of portfolios, but we do not consider them to be a suitable tool for retail investors. Their yield often does not match the associated risk. Private bond issues cannot be considered safer securities than shares of large companies. And their yield is usually lower than the yield of stock markets. They are illiquid and carry a significant credit risk. Furthermore, their revenues are liable to tax.

The securities dealers in Slovakia

just a few offer relevant investment products. However, you would not find among them any portfolios that would beat the market in the long run. Their risk is disproportionate. The fee structure takes into account primarily the trader's interests and only after that the client´s. The minimum required-entry investment often represents an insurmountable barrier for most Slovaks.

Invest like a pro

With low fees, no emotions and tax smart.

The remaining investment option is to open your investment account directly with an online merchant. This option is the most attractive from the cost perspective. To manage your investments effectively, you need a lot of knowledge, passion and especially time. However, most people are not keen on weeks of learning about the investment world, which is fine and understandable. However, it cannot be a reason to not invest and let your savings depreciate.

If you manage your portfolio on your own, there is only a low chance that you will outperform the market despite the low fees. Emotions, fear, lack of information and time quickly deprive you of profits.

Other options you may encounter are mostly misleading or just pure speculations. As a rule, you end up with negative experiences.

Market revenues are the optimum profit, which you can earn over the long term. You can hardly earn more somewhere else. Yields above the market average are speculations or carry significantly greater risk. Therefore, we provide a passive investment through index ETF funds.